5 Best Practices for Managing Cash Flow

Maintaining a cash reserve is critical to surviving business shortfalls. Most businesses struggle with the correlations between collections from customers and vendors. It’s easy to see why when you step back and remember 60% of small business owners do not have formal business education. This means as the accountant/bookkeeping working with these businesses we have a unique opportunity to help them understand critical information about their business.

1. Understanding is the First Step

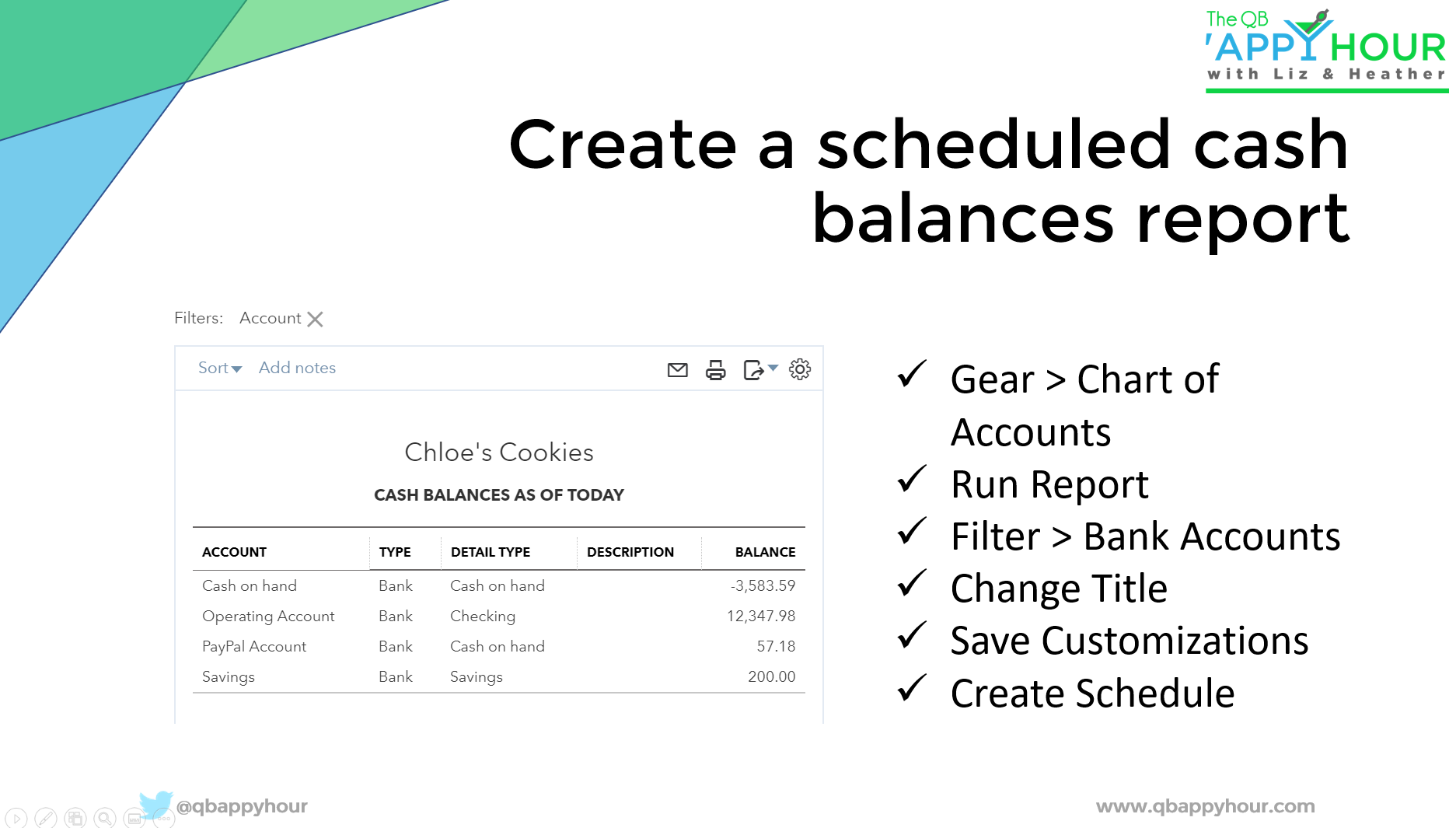

Your role is to breakdown the numbers into a meaningful conversation. During QB ‘Appy Hour, Heather demonstrated how to use QuickBooks Online to create and schedule a cash balance report. By creating this custom report, you are creating a tool for business owners to use to track their bank balances.

2. Where did the Money Go?

As an advisor, I am sure you have heard the confusion small business owners have when they look at a profit and loss statement and are in disbelief in the amount of profit they have made. Especially, if they feel broke. This is a common scenario and looking at bank balances is only part of managing cash flow.

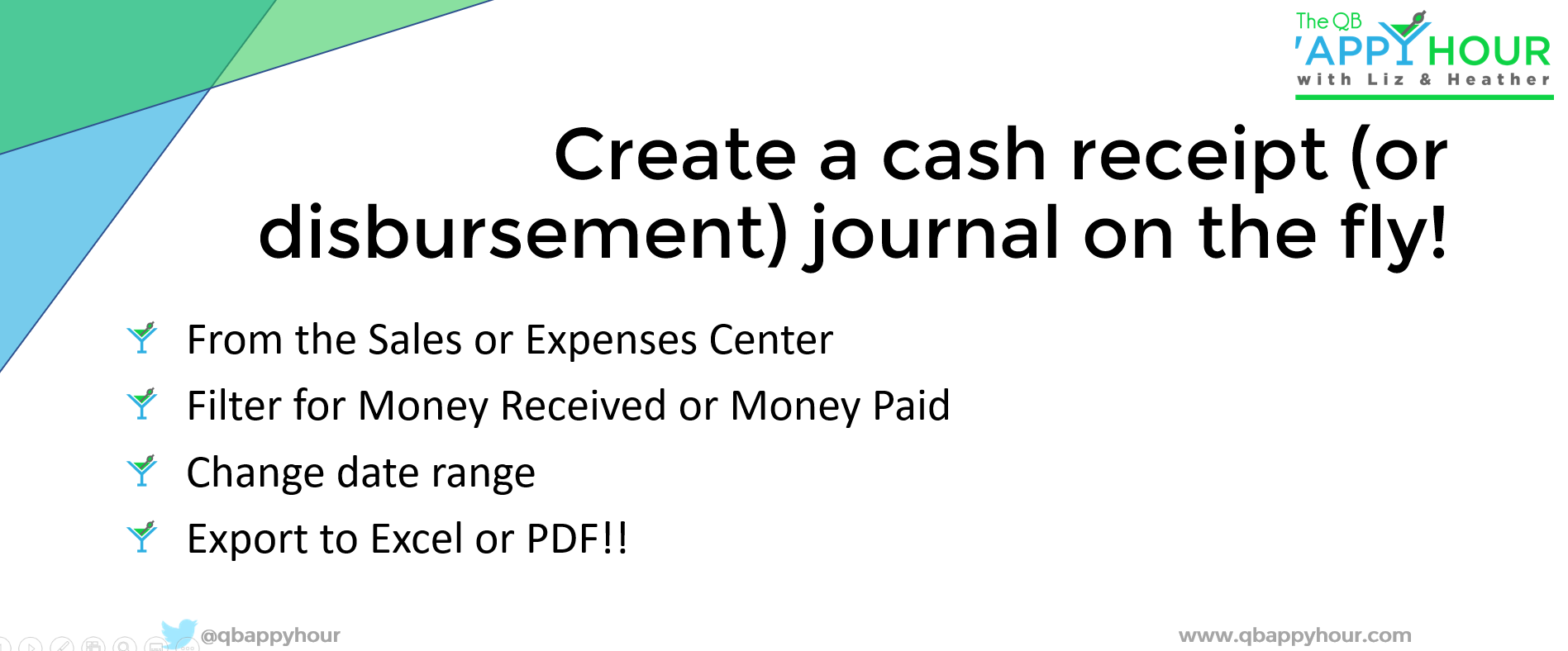

Creating a disbursement journal reveals where the money came from and where it was spent.

3. Managing Accounts Receivable and Payable

Business owners often overlook the importance of managing accounts receivable and payable aging. There are several reports within QuickBooks Online to help understand the aging of these accounts. Using them to explain a long period between performing the work and collections means bills go unpaid. Unfortunately, many businesses learn this lesson the hard way when they are unable to meet payroll or payable deadlines.

4. Use a Cash Flow App

Lack of cash flow is the number one reason businesses shut down. There a few custom reports within QuickBooks you can use to create and gather cash flow information but using a cash flow app makes managing the numbers simple. During QB ‘Appy Hour we looked at Cash Flow Frog for cash flow insights.

Apps need to be easy to use and understand in order to be of value. Cash Flow Frog’s color-coded graphs and bar charts make reading the reports simple and straightforward.

Cash Flow Frog evaluates key areas of the bookkeeping and aides in the discovery of potential problems. Because the app attaches directly to your data file updates are detected quickly.

5. Schedule Client Meetings

Don’t doubt the importance of working through the numbers with your clients. Coaching adds tremendous value to the monthly recurring work you perform. The better they understand the numbers the better their chances are at having the business they really want.