Sales tax is time consuming, annoying, and flat out confusing. Even more so in the middle of a global pandemic. Thankfully, we had the pleasure of speaking with Avalara on our latest episode to give us insights on how they can help make calculating sales tax easier.

We were so excited to have Matthew Hammonds, Sr. Sales Manager from Avalara, join us as we discussed why you should invest in Avalara.

With this pandemic, e commerce is in high demand! More stores are moving to an online storefront which means collecting sales tax on products being sold online. A lot of these converted store fronts are here to stay too.

Selling to clients in one state is one thing but when you have an online store front your clients become worldwide which means not only do you have to comply with tax in your own state, but you also have to be knowledgeable with tax compliance in many different states. For example, Maryland decided to charge sales tax in the middle of the month for goods sold online. It is extremely hard and can be discouraging when you feel you must have all this knowledge for fear of being called out by the IRS.

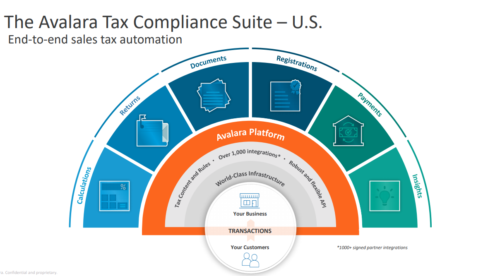

This is where Avalara comes in to save the day. They have a large staff of tax professionals that stay on top of all sales tax laws and regulations which keeps you confident that you are complying. Avatax is a tax engine offered by Avalara that helps with tax calculations. The calculation service also can let you know if what you sell is even taxable. Avatax works with over 800 different apps to ensure that you get the answers you need

To learn more about drink recipes and show details follow us on our Facebook page or check out our website www.theappyhour.com.

Register for The ‘Appy Hour by clicking here.

To learn more about the show sponsor, follow the link to: Avalara