We were so happy to have a Settle on for our Appy Hour Episode. We did a deep dive into Settle to explore its wide range of features and its capabilities.

Meet Alek Koenig

We spoke with Settle’s Founder and CEO Alek Koenig. Alek kicked off his career at Capital One, putting in six years mixing it up in risk management and consumer lending. Then, he spent a solid four years at Affirm, where he was the driving force behind building an underwriting function and leading the credit team. From pricing strategies to managing portfolio risk, he’s been there, done that, and now he’s bringing all that expertise to Settle.

Meet Pete Potsos

We also got to speak with Pete Potsos, the Head of Accounting Partnerships at Settle. With his extensive experience in launching cloud-based client accounting services practices and his dedicated focus on identifying what makes exceptional accountant partners, Pete’s insights are truly indispensable.

How Settle Works

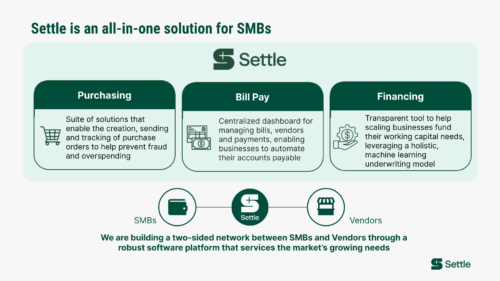

Settle is the ultimate solution for simplifying your financial operations. Their platform seamlessly integrates bill payment, purchasing, and financing, providing a hassle-free experience. Whether you’re paying vendors, managing purchase orders, or handling invoices, Settle has you covered.

Settle makes it easy to create, send, and track purchase orders, reducing the risk of fraud and overspending. Their centralized dashboard simplifies bill management, vendor communication, and payment automation, making accounts payable effortless. Additionally, their transparent financing tool, powered by a holistic machine learning underwriting model, helps growing businesses secure working capital with clarity and confidence. Settle is dedicated to building a robust network between SMBs and vendors through our innovative software platform, catering to the evolving needs of the market.

If you’re interested in learning more about Settle, be sure to check out their website, or you can watch the episode by visiting our YouTube!